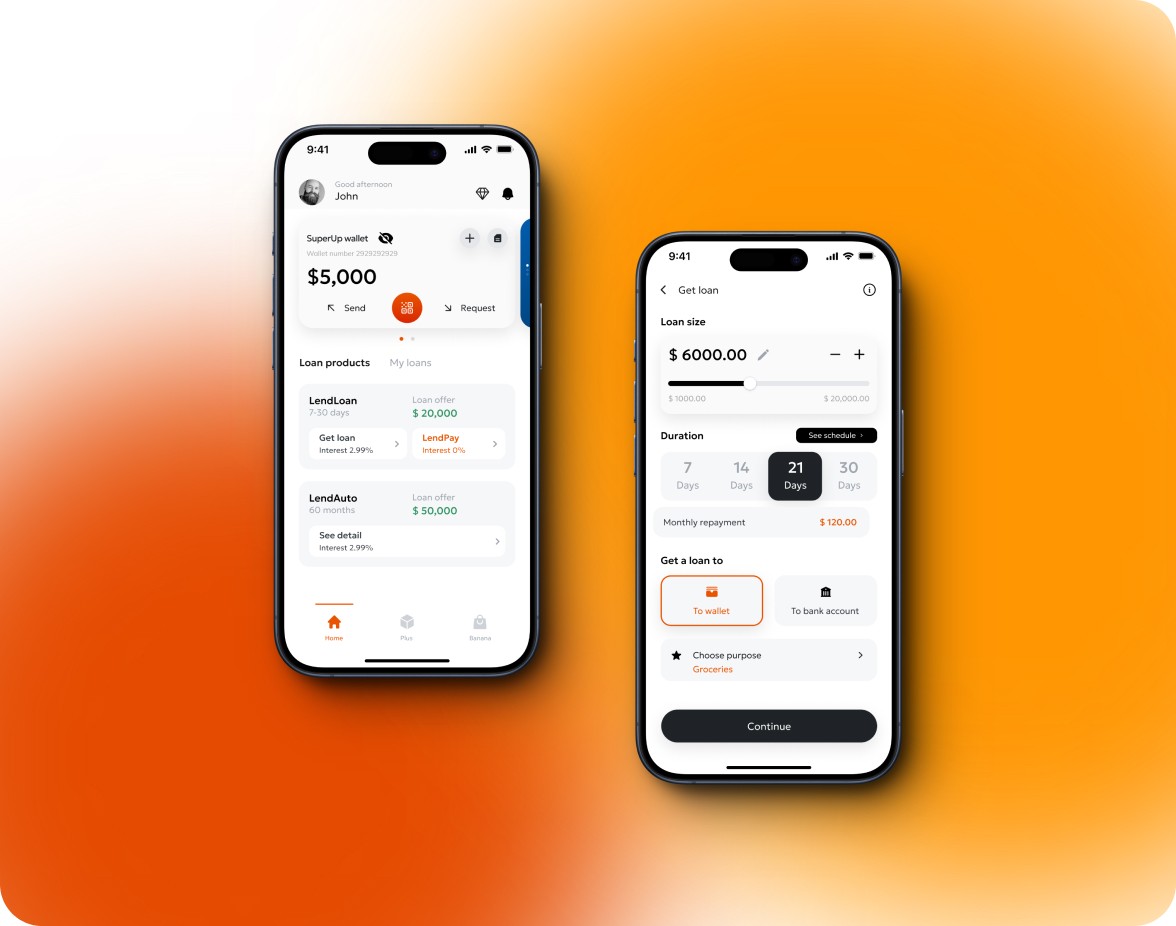

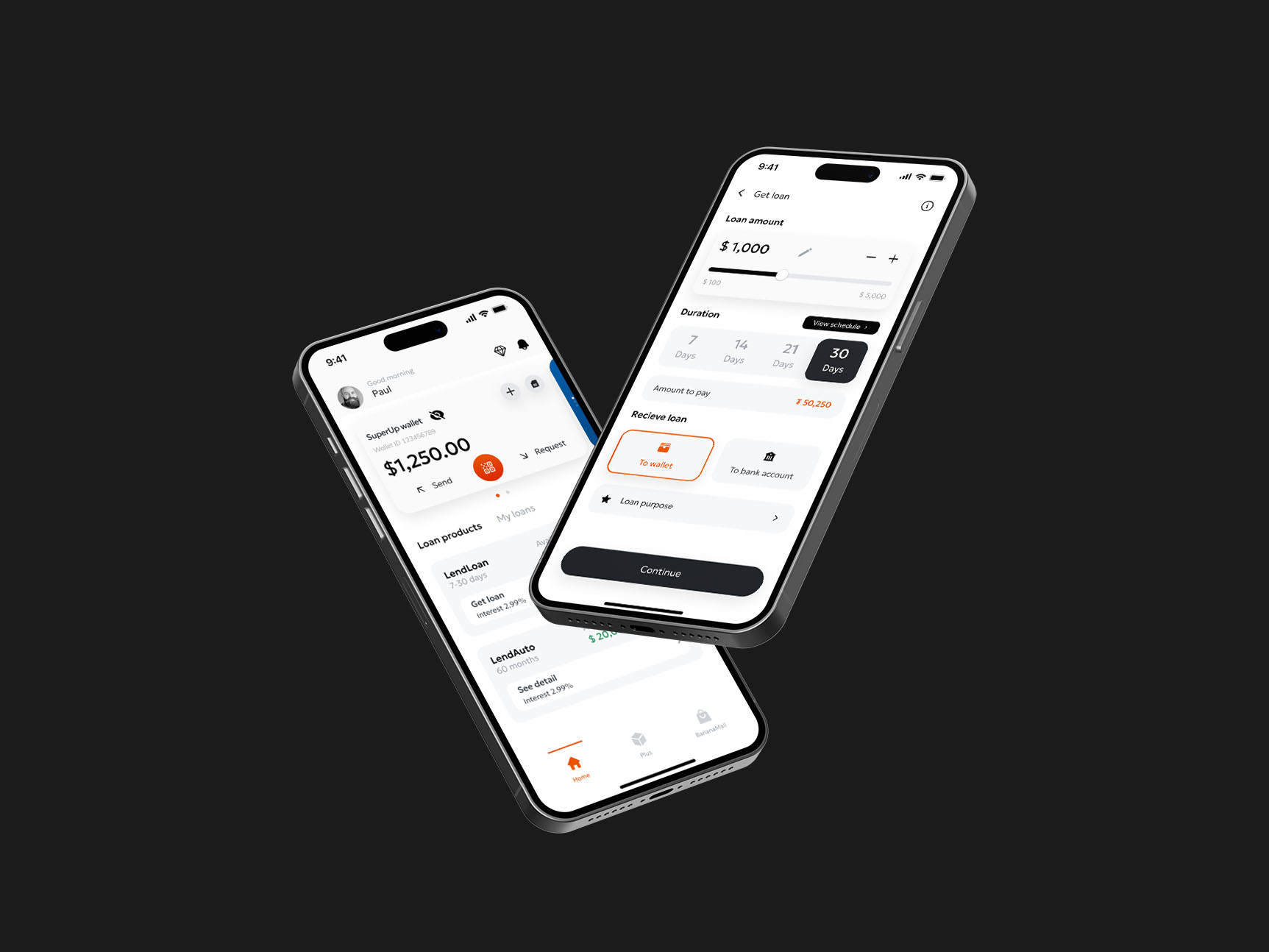

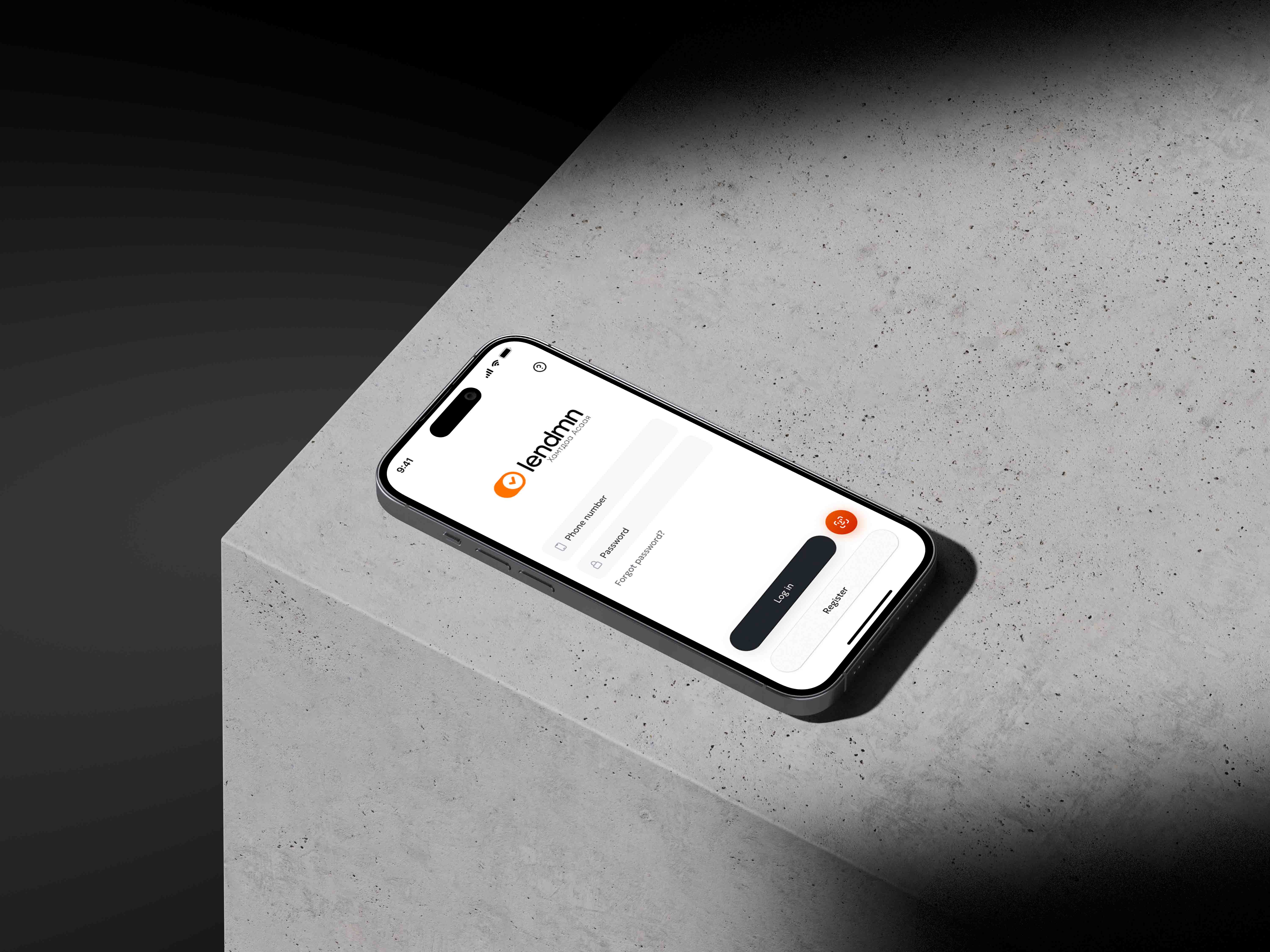

Micro Lending, Wallet app

Serving as a purveyor of non-collateral, cost-effective consumer digital loans application

Role

UX/UI, Research, Graphic Design

Industry

Fintech, Wallet, Investment

Challenges

Complex Application Process:

Simplifying the loan application process while ensuring compliance with regulatory requirements can be challenging. Designing a user-friendly interface that collects necessary information efficiently without overwhelming users is crucial.

Repayment Management:

Designing features to facilitate loan repayment and encourage responsible financial behavior is important. Creating flexible repayment options, automated payment reminders, and incentives for timely repayment can enhance user experience and reduce default rates.

Solution

User-Friendly Interface:

Design a clean and intuitive interface that guides users through the loan application process step by step. Use clear instructions, visual cues, and progress indicators to help users understand where they are in the process and what actions they need to take next.

Minimal Information Requirements:

Streamline the application form by requesting only essential information upfront. Prioritize collecting information that is critical for assessing creditworthiness while minimizing unnecessary fields to reduce user friction.

Other projects

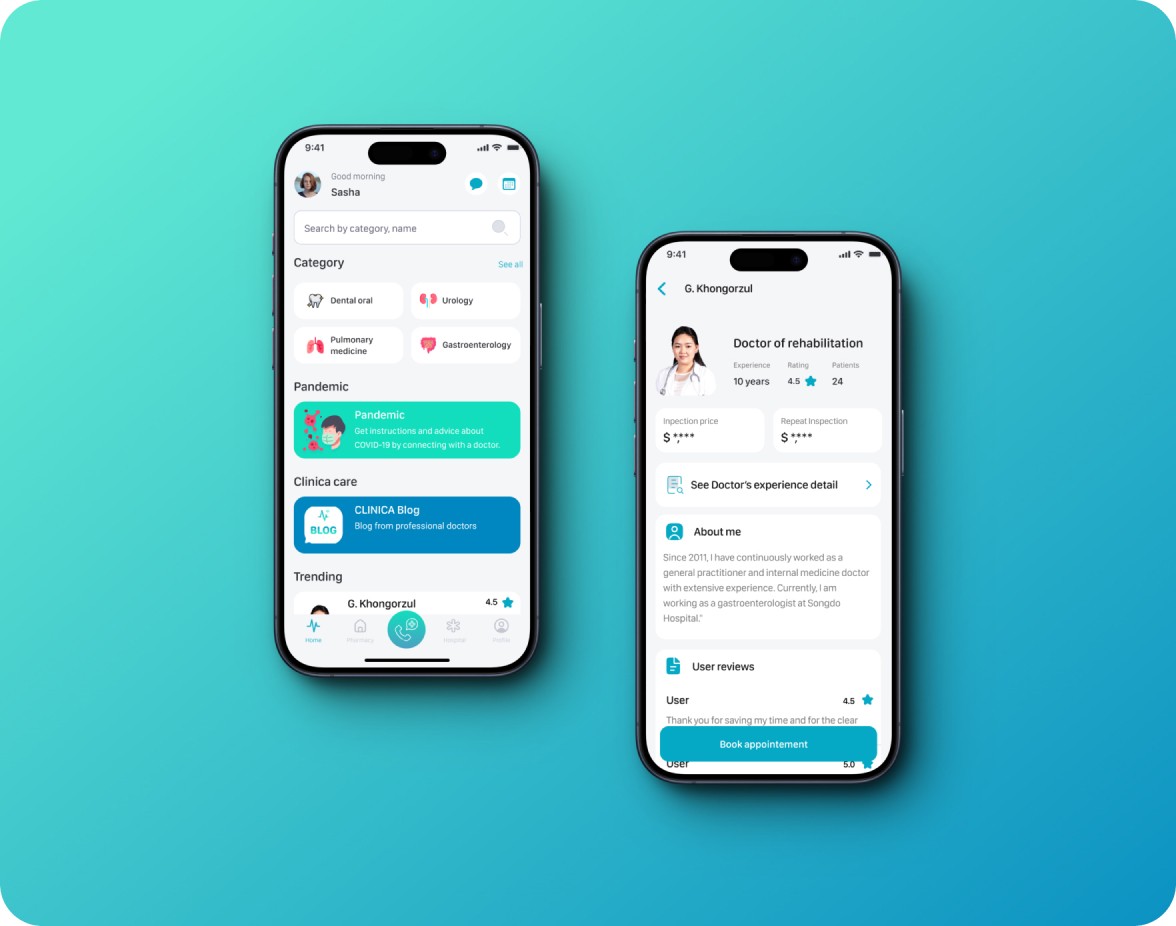

Clinica Telemedicine App

Collaborated within a Start-up team of 5 members to develop Clinica, a telemedicine application.

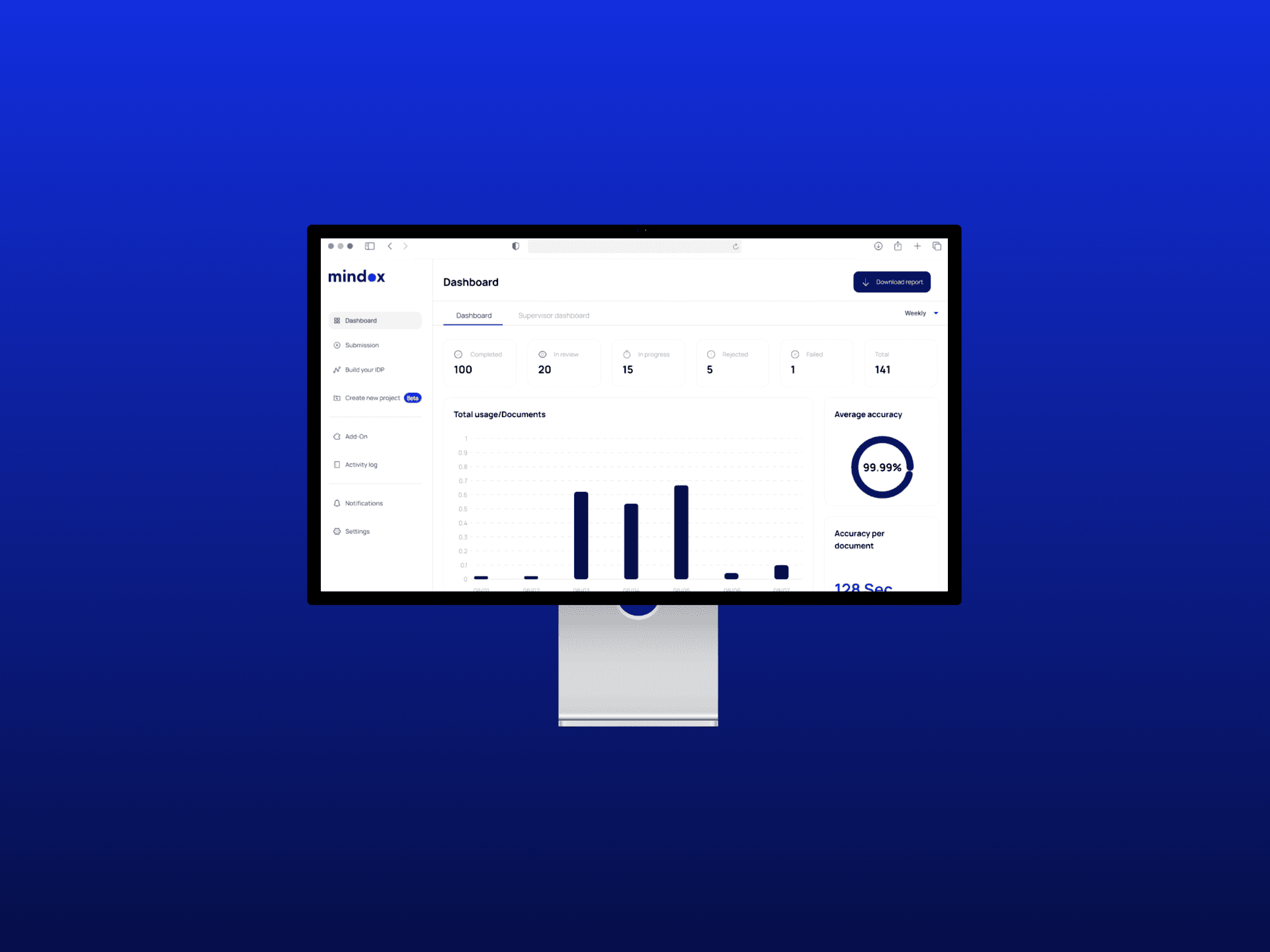

mindox Ai OCR platform

Reduce manual tasks, enhance data accuracy, and optimize workforce deployment for greater efficiency.

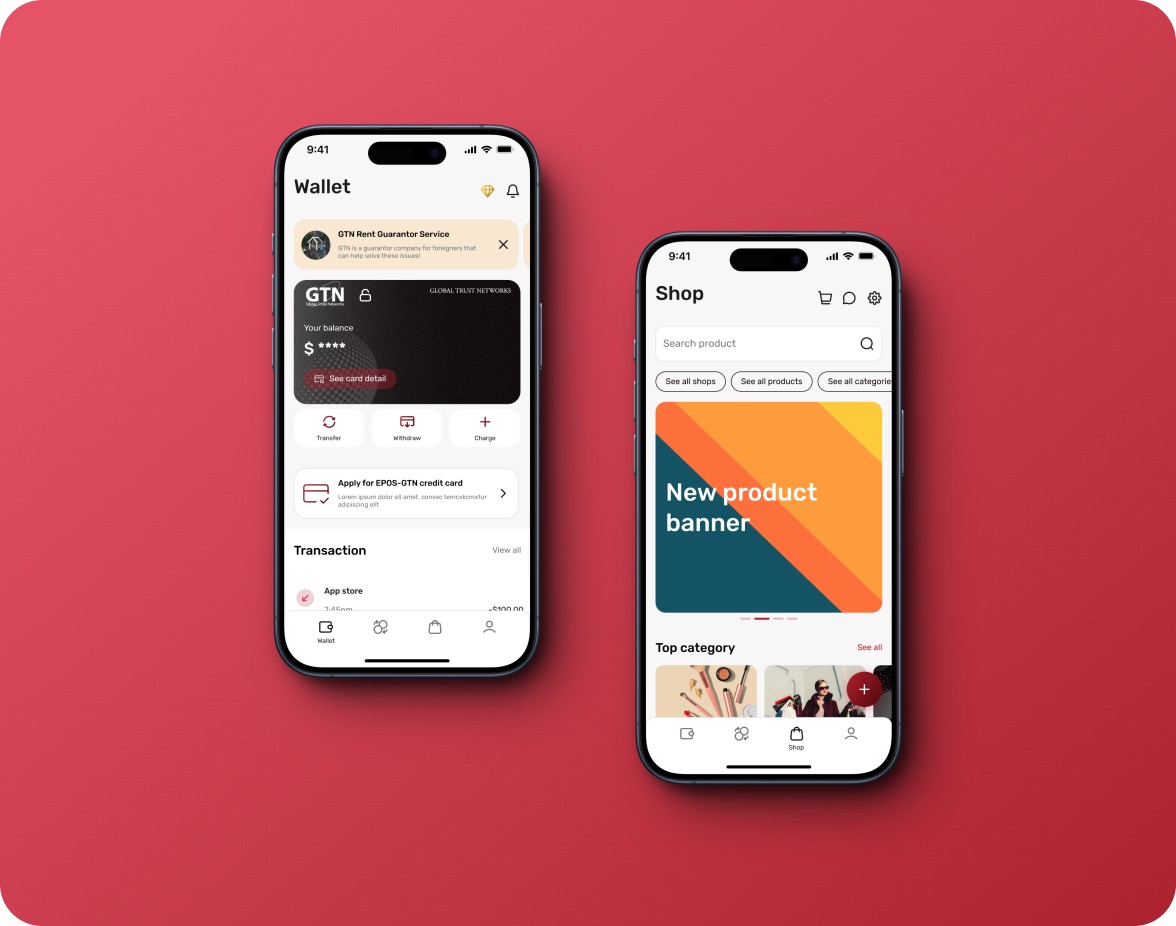

GTN Wallet app

GTN wallet, loan, and ecommerce app, designed to cater to the dynamic needs of Japanese users.